English Football League - Financial Health League Table

The financial health of Football League clubs has recently been the subject of much debate. In contrast with Premier League clubs, which benefit from ever-higher TV broadcasting revenues, Football League (EFL) clubs have disproportionately suffered from the loss of fans’ attendance during the pandemic. The loss of gate receipts and other revenue has been devastating, with a parliamentary committee hearing that 10 EFL clubs were struggling to pay wages in November 2020. This culminated in the Premier League and EFL agreeing to a £250 million bailout in December, to help struggling clubs weather the storm. In total, this comprised a £200 million loan for Championship sides and a £50 million grant for those struggling in League One and League Two.

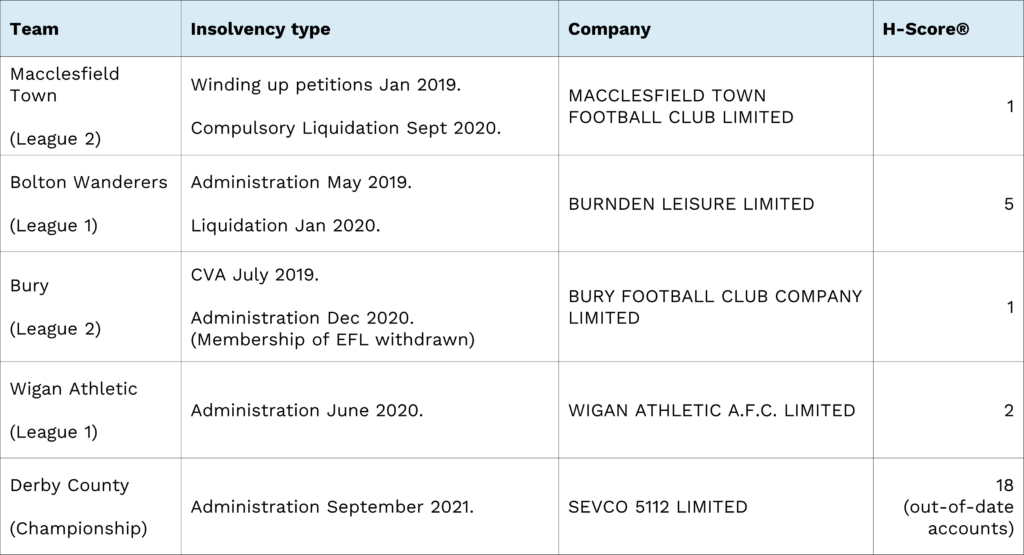

The difficult situation facing many lower league clubs was highlighted dramatically last week when Championship club, Derby County fell into administration with estimated losses of around £1.5 million per month. This makes Derby the fifth EFL team to experience financial distress in less than three years:

At Company Watch we use our financial analytics to assess the financial strength of UK companies by taking an in-depth look at their balance sheet and profit and loss statements. Our proprietary credit risk score, the H-Score®, measures how likely a company is to go into financial distress over a one-year time horizon. The score ranges from 0 (weakest) to 100 (strongest). Companies with an H-Score® of 25 or less fall into the Warning Area, and are particularly vulnerable to financial distress.

Here, we analyse the financial health of the 72 EFL clubs (not the Premier League), to give a view of which clubs are most likely to survive the pandemic. For each club, we consider the most recent set of accounts filed at Companies House. Where the company is part of a larger group, we consider the highest UK-based parent company with consolidated (group) accounts. Although in some cases the parent’s activities extend beyond the football club itself (e.g. Stoke City are owned by Bet365), we take the view that these group accounts generally give the best overall picture of a club’s financial situation and the likelihood of distress. We summarise our results in a new financial health league table (see below).

Financial stability and profitability

Of the 71 clubs included in the analysis (Derby County are excluded because their accounts are too old), 62% are in the Warning Area (42 clubs). This is markedly higher than for the sports industry as a whole, where this percentage stands at 37%. The implications for the clubs’ financial stability are serious: in the sports industry1, a company in the Warning Area is around 7 times more likely to experience financial distress than a company outside the Warning Area. At the extremes, a sports company with an H-Score® of 0 has approximately a 10% chance of financial distress in the next year, while a company with an H-Score® of 100 has around a 0.05% chance.

Not all of the 71 companies filed a profit and loss statement in their accounts: 15 companies across League One and League Two took advantage of exemptions for small companies and filed only a balance sheet. Of the remaining 56 companies, 70% were loss-making (39), casting further doubts on the sustainability of their business models.

Financial health comparison between EFL divisions

|

League |

Net Assets (£Mn) |

Net Sales (£Mn) |

Net Profit (£Mn) |

Number in League |

Number in CW Warning Area |

Number Loss Making |

Number Profit Making |

Number No Profit & Loss Account |

|

Championship |

5762.8 |

3781.6 |

-148.4 |

23* |

16 |

18 |

5 |

0 |

|

League One |

640.6 |

266.4 |

-29.1 |

24 |

14 |

14 |

6 |

4 |

|

League Two |

736.7 |

456.8 |

1.2 |

24 |

14 |

7 |

6 |

11 |

(As above - Derby County (Championship) are excluded because their latest accounts are too old.)

The table above shows key figures for each division. Even after removing the £2.8 billion revenue of Stoke City’s parent (Bet365), the Championship dominates the EFL in terms of financial activity, with total revenue more than double that of League One. Although the total revenue of League Two is seen to be greater than that of League One, this is mainly due to the high revenues of the parent companies of Forest Green Rovers and Harrogate Town (Ecotricity and Strata Homes, respectively). When these clubs are excluded, the revenue falls to £134 million, around half that of League One.

The number of clubs in the Warning Area is fairly consistently high across the divisions (58 to 70%). Only five clubs in the Championship turned a profit, with the largest being the £137 million reported by Stoke City’s large parent. In contrast, Bournemouth and Fulham, who currently sit in the top two positions in the Championship, made the largest losses of £60 million and £48 million, respectively. This may be driven by poor performance and relegation from the Premier League.

Foreign ownership of EFL clubs

Of the 71 companies, 19 are ultimately owned by overseas holding companies whose accounts are not available to us. Care should be taken when drawing conclusions based on the UK companies alone, since these may not represent the financial health of the entire group.

Conclusion

The clubs with the lowest H-Scores and greatest losses tend to be in the Championship. These clubs are often aiming to break into (or return to) the Premier League and operate a business model built around achieving that aim. Since not all clubs can achieve promotion, it follows that this model is unsustainable in most cases, and many clubs rely on rich owners to prop them up. By contrast, AFC Wimbledon, which is largely owned by fans, sits on top of the financial health league table (below), with an H-Score® of 99 and profits of £12.6 million in the year up to June 2020.

The majority of accounts used in this analysis date from 2020, and will not include the full effects of the pandemic, in particular the loss of gate receipts in the 2020-2021 season. To assess the full impact of the pandemic, it would be interesting to repeat this analysis with accounts covering the 2020-21 season, when they are released.

Financial Health of Football League Clubs

We have compiled a financial health league table of all clubs in the EFL, ranking clubs H-Score® high - low. Any club with an H-Score® of 25 or less falls into the Company Watch Warning Area and is at serious risk of financial distress. View the league table below.