How credit reference agencies turn data into powerful risk insights

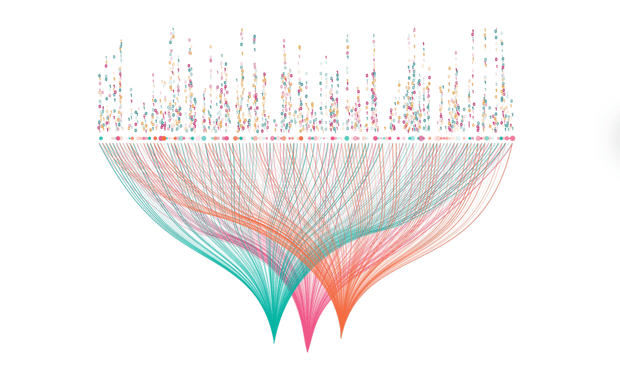

In our age of unlimited information, risk evaluators have access to millions of financial data points. This has made it easy to find information, but much harder to draw meaningful conclusions. Not all data is created equal. Forgetting this can lead to serious errors of judgement.

We want to help you avoid the pitfalls of information overload. As a Company Watch customer, you don’t just gain access to the most reliable financial data. You also get the tools to turn it into meaningful insights.

In this blogpost, we discuss how we can help you cut through the noise and make risk predictions that you can count on. You'll learn:

- How a traditional company credit score is calculated

- How powerful risk insights are generated with Company Watch

How is a traditional company credit score calculated?

Traditional company credit scores are based on a “scorecard” approach. Credit reference agencies judge a company against common financial indicators, and then use the results to provide a single company credit score. This is usually based on how likely the company would be to pay a supplier within 30-60 days.

This is fine for an overview, but it lacks depth. It tells you the overall level of risk, but not the individual factors behind it. A credit reference agency will give certain risks greater weighting than others, and this might not reflect the reality of your business. Read our ultimate guide to company credit scoring here.

This approach is also vulnerable to bad data, especially if you're using a single agency to evaluate a range of businesses. A credit reference agency might have access to great data in one industry, but not in another. It might have lots of information on UK businesses, but next to nothing on foreign companies.

One solution is to use multiple credit reference agencies. This reduces the risk of skewed results, but it doesn’t solve the depth problem. You’ll end up with multiple company credit scores, but you still won’t know what they're based on.

We address these problems by taking a two-pronged approach to risk prediction. We do everything we can to maximise the quality of our raw data, and we provide the best possible tools to sort through it. Let’s take a closer look.

Data you can trust

A lot of our raw data is keyed data (data that has been entered manually). As you can imagine, this process is vulnerable to human error.

We guard against this by checking every data set twice. Our data supplier performs a series of initial checks, and then we perform our own automated checks. Some mistakes are bound to slip through, but these safeguards significantly improve the reliability of our data compared to other credit reference agencies in the UK.

More than a company credit score

Our basic mission is the same as a traditional credit reference agency - to help you predict the risk of doing business with a company. The difference is in the level of detail we provide. While most credit reference agencies give you one score, we give you multiple, each accompanied by a full explanation:

- H-Score® - is our version of a standard company credit score, but with one key difference. Rather than looking at a company’s accounts in isolation, we look at how closely they resemble the accounts of similar companies that have failed. We use this method to score companies out of 100, with a score of 25 or less considered high-risk.

- PoD® (Probability of Distress) - gauges the likelihood of a company suffering a distress event such as a reconstruction or a full business failure. We take the same data that we used to calculate the H-Score® and combine it with external economic indicators to work out the probability of a distress event occurring in the next three years.

- TextScore® - uses advanced machine learning to analyse the text in a company's financial reports. It searches for phrases and patterns of words that have appeared in the records of similar companies that have failed in the past. Doing this on a large scale allows us to spot weaknesses that may have been hidden at first glance.

💻 See our scores in action - arrange a free trial today

Go deeper

These scores are only the beginning. At Company Watch, we don’t just look at the present state of a company’s finances. We let you assess its stability in the months and years to come.

Our customers can access our award-winning Forecast View™ tool. This allows you to simulate a range of financial shocks and see how they would affect a given company’s H-Score®. You can choose from pre-selected scenarios including margin squeezes, spikes in demand and key customer insolvencies. In every case, the H-Score® is adjusted automatically and compared to the industry average.

If you want to delve deeper, our Experiment functionality lets you run your own simulations and stress tests. You can adjust individual variables and timeframes, and even add your own figures from company reports. This is especially useful if you want to isolate a single area of risk and see how it could affect the company’s overall health.

📙 Download our PDF to learn more about Forecast View™

A traditional company credit score is only reliable if the credit reference agency's priorities reflect your own. We let you zero in on the risks you care about so that you can make reliable, evidence-based decisions every time. Read our ultimate guide to company credit scores here.

📲 Get in touch to find out more, or ![]() follow us on LinkedIn for all the latest news.

follow us on LinkedIn for all the latest news.

Disclaimer- The past performance of a company is not always an indicator of future success. Read our terms and conditions here.