Know your customer - the key to better risk planning

Craig Evans, CEO

Craig Evans, CEO  Philip King, Credit Management Consultant

Philip King, Credit Management Consultant

Even if your customers are trustworthy, they can still expose you to risk by doing business with less reliable companies. This was illustrated recently by the collapse of Carillion. 30,000 businesses were left out of pocket, many of whom had no idea that they were indirectly linked to the company.

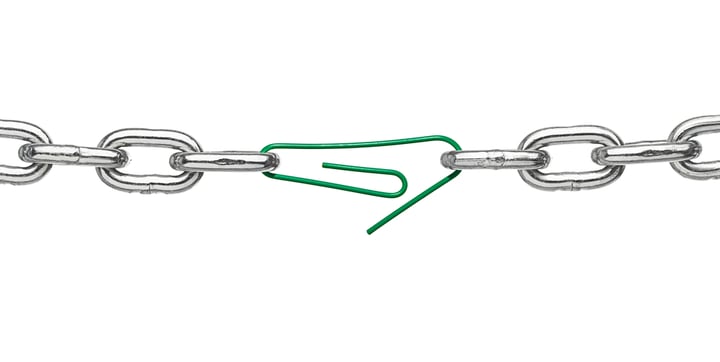

As the world grows more interconnected, businesses are increasingly part of complex supply chains. Understandably, this translates to increased supply chain risk. These supply chains are only as strong as their weakest link, a link that may be several steps removed from your own.

In order to avoid a similar scenario, you need to examine your customers’ customers and your suppliers’ suppliers. This is what "know your customer" means. This is hard work, but Company Watch can help with our supply chain management solutions. Here’s our guide to spotting supply chain risks, and how Company Watch can make sure you find the information you need.

Top 10 - Know Your Customer Checklist

Before you grant credit to a customer, it's important that you know your customer.

Learn 10 vital things you should do, and 10 risks to watch out for when extending credit to a customer in our free guide.

Knowledge is power

We’re sure you understand the importance of performing due diligence before extending credit to a company. Due diligence helps you know your customer better and mitigate supply chain risk. This process will vary depending on the nature of the business, but there are some things that you should always check:

- Find out the name and trading style of the business. Are they a sole trader, a limited company or a partnership? Establish the names and addresses of the proprietor or partners, and ask to see documentation that verifies this information.

- If you are dealing with a limited company, check their records using the Companies House website.

- Use a credit reference agency to check their credit status. If you have doubts about their creditworthiness, consider asking for a partial payment in advance. Read our ultimate guide to company credit scoring here.

- Talk to other businesses that supply them. What is their reputation? Do they have a history of late or missed payments? This will reduce supply chain risk in the long run.

- Find out why they left their previous customer. Was it their decision, or did the customer have reason to end the arrangement?

- Check if they have signed up to an initiative such as the Prompt Payment Code or the Good Business Charter. This shows that they are committed to paying their suppliers on time.

Know Your Customer red flags

The way that a business responds to Know Your Customer requests can tell you as much as the information itself. When dealing with a potential customer, there are several red flags to look out for:

- Reluctance to provide information 😑

- Being overly cooperative, perhaps in the hope that you won’t look at their records too closely 👋

- Pressuring you to supply them before you have completed the necessary checks ⏰

- Providing references that seem overly positive 📝

- Telling you to ignore the information provided by a credit reference agency 📴

![]() Follow Company Watch on LinkedIn

Follow Company Watch on LinkedIn

Know Your Customer - Take the guesswork out of risk assessment

Building strong relationships with your customers and suppliers will make it much easier to find this information. With trusted partners, it may be a simple case of paying them a visit and asking a few questions.

But things get harder as you move further along the chain. Since you are not dealing with these companies directly, they will probably be less forthcoming. The only way to be sure is to examine their records yourself, and this is where we can help.

Company Watch offers a range of services that go far beyond those of a standard credit ratings agency. We’ve converted hundreds of thousands of company records into searchable text files, allowing you to find detailed information on a given business without wading through a sea of documents. If you are concerned about a certain supply chain risk, you can search a company’s accounts for relevant keywords. This lets you spot dangers that may have been hiding in plain sight.

As well as painting an accurate picture of a company’s present state, we can also provide detailed projections of its future performance. If you want to see how a business would cope with a sudden fluctuation in interest rates, or whether it could survive the loss of a key supplier, we can create a tailor-made model to answer your question.

With our intuitive dashboard, you can simulate a variety of market shocks and immediately see their likely effect on a company’s risk profile. If you want to dig deeper, our “Experiment” feature lets you input exact numbers from interim reports and use them to project future scenarios.

Just because you don't deal with a company directly, it doesn't mean that their finances should be a mystery. We shine a light on the entire supply chain so that you can make decisions with confidence.

Get in touch to arrange a free trial today.

Disclaimer- The past performance of a company is not always an indicator of future success. Read our terms and conditions here.