Nobles Construction Limited

In June 2021, Nobles Construction Limited (NCL) went into Administration after a difficult period throughout the Covid-19 pandemic. The pandemic certainly exacerbated issues for many businesses, however, we could see a good number of clues that, regardless of the influence of Covid-19, NCL was facing significant financial challenges as a business.

Brief Overview

NCL are specialists in the construction of commercial real estate with elements in the residential space. They were founded in 1995 and focused on projects in the Northwest of England from their base in Liverpool.

Before Covid-19

There were signs before the outbreak of the pandemic that NCL were operating with incredibly thin margins and were leaving themselves susceptible to a downturn in their economic fortunes:

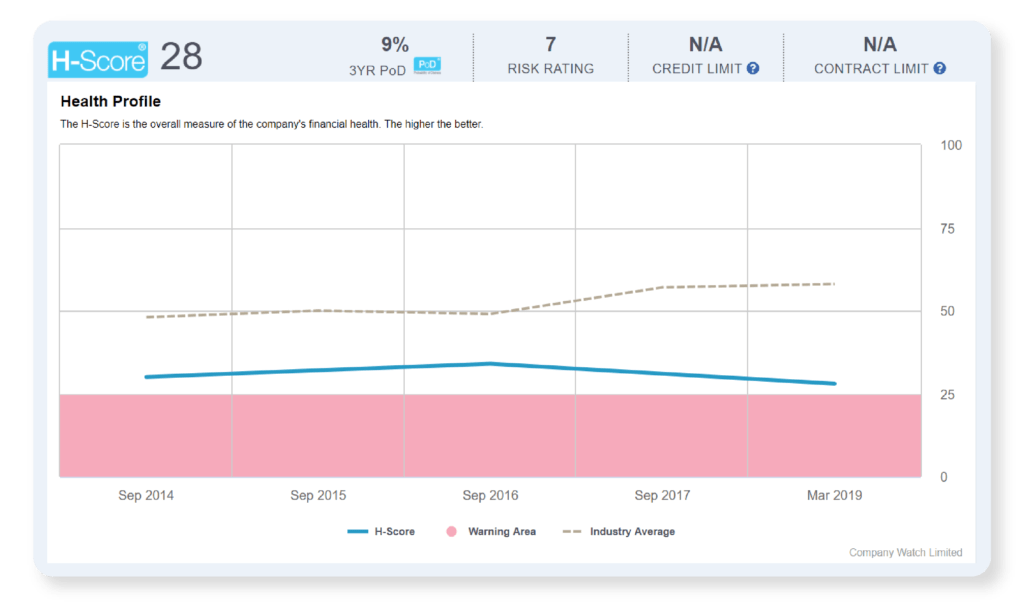

Since 2014 the H-Score® of NCL has been close to the Company Watch Warning Area. Most of NCL’s issues were attributable to its weak profit and funding management and in the balance sheet, its high dependence on suppliers & other creditors who all need to be paid within 12 months.

Covid-19

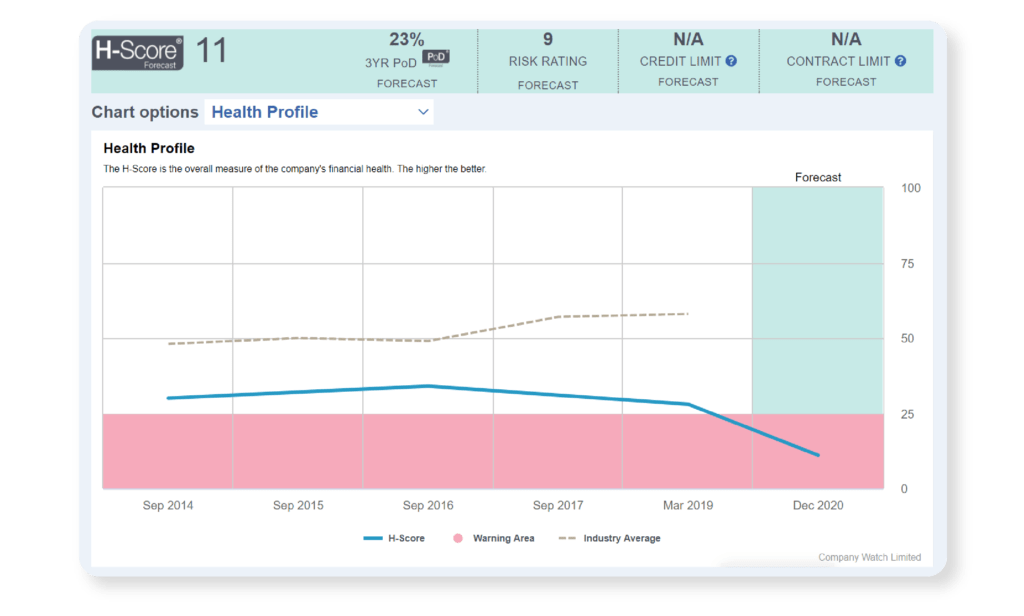

The onset of the Covid-19 pandemic, of course, had a profound impact on the UK economy but it was especially severe in those sectors which required on-site attendance such as parts of the construction industry. Company Watch launched its Covid Scenario Forecast H-Score® in April 2020, and, taking into account the sectoral projections, this quickly reflected the increased difficulty of NCL’s trading conditions, moving the company firmly into the Warning Area. The Covid forecast was available some 14 months before the appointment of administrators. Between January and April 2021, NCL were issued with £110,000 of CCJ’s so there were strong indicators of the company struggling in 2021.

Projecting Financial Health

With the current volatility in the UK economy, it is more important than ever to have consistent tools to be able to forecast the future viability and financial health of businesses. NCL offers a compelling example of how the Company Watch Platform can be used to predict the future performance of a business without relying on statutory filings. This case shows why, in some cases, it is no longer enough to rely entirely on historical data when reviewing a company’s creditworthiness; we must consider intelligent, forward forecasting in our decision-making processes.