Rapid Succession And Director Fraud Are Rising, What Can You Do About It?

As times remain tough, you need to be on the lookout for unethical behaviour. UK insolvencies have risen to a 14-year high. One of the consequences of this is an increase in business fraud and Rapid Succession.

Let’s take a closer look at how Rapid Succession can affect your business and how we can help.

What is Rapid Succession?

Rapid Succession is the rapid movement of incorporation(s) either prior to or following insolvency action against a company where the new company or companies are linked to the company that experienced insolvency action by one or more common directors. Although the population of companies that meet these criteria are legitimate and of no legal concern, the population also includes legitimate phoenixisms (if incorporated and operated in accordance with the law), and a subcategory of illegitimate phoenixisms where the applicable law has not been followed or where the director(s) intend or intended to commit fraud.

Why worry about Rapid Succession?

While you may find Rapid Succession frustrating, it is, in most cases, a legal practice. More businesses are finding themselves in difficult circumstances, which makes it likely that more companies will turn to Rapid Succession. Before the current financial crisis, we saw low inflation and low borrowing rates, this meant cheap borrowing for companies with negative bank balances.

Now that we are seeing rising levels of inflation, the result is that these ‘zombie companies’ cannot survive.

At Company Watch, we’ve monitored these zombie companies that you need to look out for. There are currently 247,631 in the UK, with a combined negative net worth of £128bn.

The temptation for company directors to write off debt and start again fresh is understandable. But unethical directors can repeat this behaviour, causing business fraud and leaving devastation in their wake. The consequences of this behaviour has a crippling ripple effect, with suppliers and small businesses often hit the hardest. Companies become insolvent, leaving creditors unable to pay their debts. In turn, this can then saddle larger businesses with bad debt.

Rapid Succession in action:

- UK Christmas savings club Farepak, went into administration in 2006.

- Over 100,000 customers lost their savings and suppliers were left unpaid.

- A new company called European Home Retail (EHR) was created by Farepak's former directors.

- EHR purchased Farepak's assets and continued its operation, leaving behind the debt.

🔥

How our director matching tool can protect you against Rapid Succession

Spotting a Rapid Succession company isn’t easy

You need to be extra vigilant when it comes to spotting a Rapid Succession company to avoid the burden of bad debt and potential business fraud. The traditional way of spotting Rapid Succession was by manually combing through the Companies House database. But this is vulnerable to manipulation. Directors often use variations of their personal details to set up new, unique accounts, hiding their association with an insolvent company. With over 5 million businesses on Companies House, it can feel impossible to find these hidden links and detect business fraud.

Standard credit checks are not comprehensive enough. If a company has hidden evidence of Rapid Succession, a standard credit score is unlikely to uncover this. This is risky as it gives you a false sense of security when working with these businesses.

We created our enhanced director matching tool to allow you to connect directorships in seconds, and successfully avoid business fraud. We’ve uncovered 104,000 links identifying over 56,000 Rapid Succession directors in the last 2 years. These companies are across all industries and the number is rising with ongoing high inflation. It pays for you to be prepared.

Enhanced director matching to the rescue

Spotting Rapid Succession companies at an early stage is key. You can refuse to extend them credit and avoid devastating debts down the line. Rapid Succession directors can go to great lengths to bury their links to insolvent companies, but they can’t hide from us.

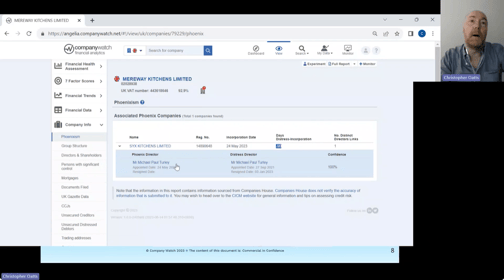

Introducing our enhanced director matching tool:

- Our powerful, automated machine-learning tool analyses director and officer details including name, location, and age.

- It then provides you with a confidence percentage that an individual director profile is linked to any other profiles. You can see all possible directorships that an individual may have held.

- This allows you to understand the current financial health of a company, and hidden links to other companies that have failed in the past.

- Our enhanced director matching allows you to sort through millions of directors on Companies House and match them to any hidden histories of insolvency.

- This can be done in seconds, giving you more time to accurately manage and mitigate business fraud and financial risk.

Enhanced director matching can help you do your due diligence, and spot unscrupulous behaviour before it becomes a problem for your business.

Watch our webinar - enhanced director matching: