Stress Test Your Way to Smarter Risk Management

Whether you’re underwriting insurance, extending credit, or supplying any other kind of financial service, doing business is risky in the current economic climate.

The concurrent market shocks of the last few years have made it increasingly challenging for risk analysts to do their job.

The latest data from the Company Watch database shows that 19.4% of UK companies are at serious risk of financial distress. With insolvencies reaching a 30-year high, our data shows 258,217 ‘zombie’ companies are barely surviving. This means there's a high chance that one of your customers or suppliers is likely to fail.

This might feel daunting, but we’re here to help you weather the storm.

We’ve created a unique forecasting tool that sets us apart from other credit reference agencies. Our Experiments functionality is for serious analysts and will help you supercharge your financial risk management.

Stress testing your way to better decisions. Let’s take a closer look at this market-leading tool and how it can transform your business.

Plan for any scenario with Experiments

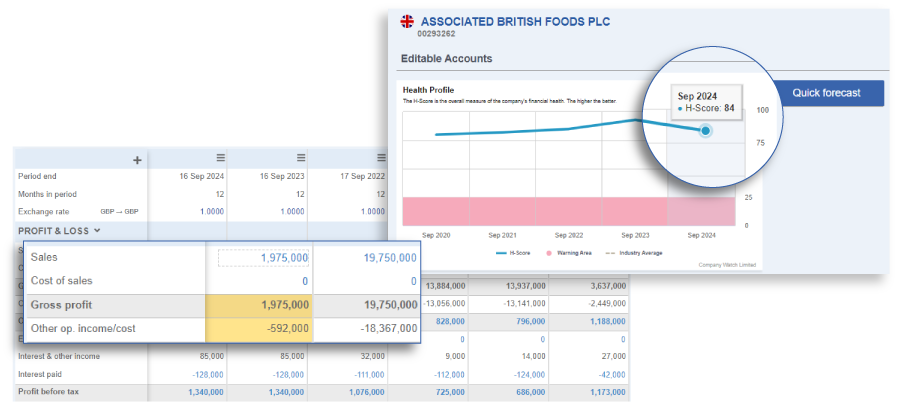

Experiments is our advanced forecasting tool, available to our Silver and Gold subscribers. This tool allows you to stress-test the financial health of your customers and suppliers using their management accounts or forecasts.

For example, you can find out the impact of:

- A 20% drop in profits

- A 15% increase in operating costs

- Increased debt servicing costs

- A write-down of asset values

This unique ability to test ‘what-if’ scenarios allows you to present evidence-backed risk decisions to colleagues and stakeholders.

Follow us on LinkedIn for the latest news and updates

How Experiments works

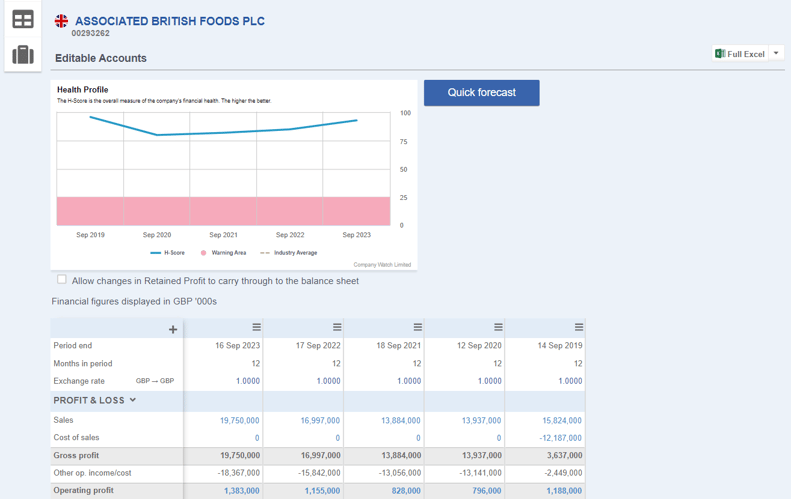

Our Experiments function is easy to use and provides you with results quickly. Here’s how it works:

- Log on to our platform and search for the company you want to run an experiment on

- Click Experiments from the toolbar

- This will open the Summary Accounts screen in edit mode

Financial modelling with Experiments

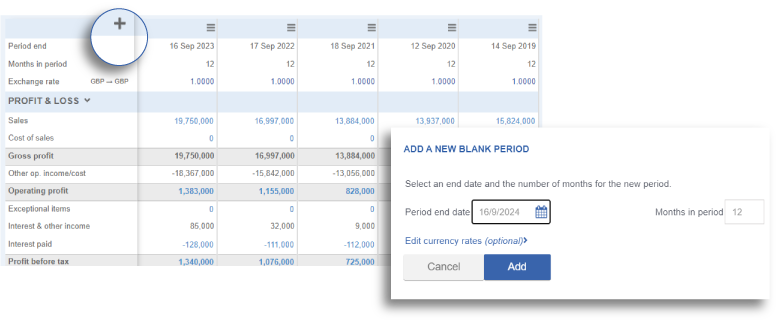

- Update the financial period end by selecting the plus button and selecting ‘add’

- You can now copy the latest company financial information into your experiment

Stress testing in action

- Edit the Profit and Loss, Balance Sheet and Cash Flow sections

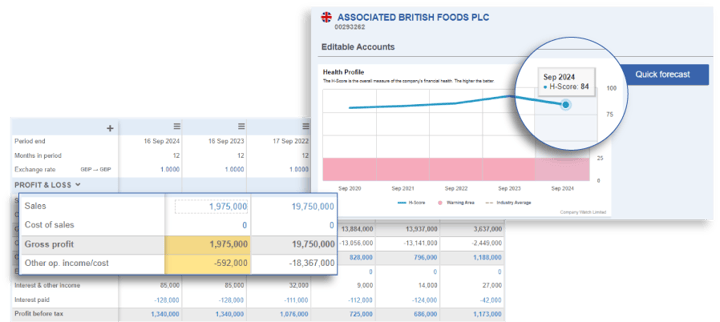

- The H-Score® will update as you enter the new information giving you a projected score for the time period

- Download custom data into an Excel spreadsheet for easy sharing with colleagues and stakeholders

Experiments can predict the likelihood of a company falling into financial distress. This empowers you to make decisions to protect your company from financial and reputational damage.

What is the H-Score®?

H-Score® is our industry-leading performance tool for predicting business failures. It analyses a company’s finances from many angles, including profit management, working capital management, liquidity and how assets are funded.

Scores are based on how similar the accounts are to those companies that have failed in the past. Scores are between 1 and 100, and scores of 25 or under place the company in our Warning Area. The vast majority of companies that fail were previously in our Warning Area.

Tips for using Experiments

- When you are entering a company's financial information into experiments, press enter after each value. The impact will be calculated immediately, with an updated H-Score® graph.

- Use the ‘Switch to Reference’ function to view the original company data.

- When editing the P&L/ Income Statement, if you want the Retained Profits to flow into the Balance Sheet, tick the box underneath the H-Score® graph. The change in retained profits in the P&L/Income statement is added to Shareholder Funds and Cash.

- If you want to remove an interim period and look at the next full year, follow the instructions to delete a period and add a new period.

Tips for Abbreviated Accounts

If you want to run experiments on smaller companies with abbreviated accounts that don’t disclose a profit, there are some tips you can follow:

- Check for values disclosed as 'Profit and Loss Movement reserve' which is provided in the balance sheet under 'Retained Earnings'.

- Subtract the retained earnings value for the current reporting period from the retained earnings disclosed in the previous reporting period.

- If the result is a negative number, make sure to enter it as a negative number in the experiment's item ‘P&L movement’ so an accurate score is calculated.

Watch to see how quickly you can start to stress-test and model company accounts!

Quick Forecast

Experiments also has a ‘Quick Forecast’ option that shows the company's H-Score® for the next year should the company report the same retained profits and income. This ability to create theoretical outcomes based on additional calendar years gives you a unique edge over the competition.

Here are some tips to get the most out of the quick forecast option:

- Rename the experiment - click on the default name ‘Experiments’ to rename it so you can easily re-access the information for a specific company.

- Create a custom report for Excel - use the drop-down arrow next to ‘Full Excel’ to customise your data selection. You can export your custom data into a spreadsheet.

- View saved experiments - by selecting the ‘My Data’ tab, you can find all your experiments available in our system. You can also use the ‘User Data’ option to find experiments related to a specific company.

- Edit the currency - select the currency options button to switch between euros, pounds and US dollars.

- Edit exchange rates - you can change the exchange rate by clicking the options button above each period-end.

- Share the experiment with your colleagues - you can grant access to colleagues by clicking the share button.

Supercharge your risk analysis

Experiments is a game-changer when it comes to risk analysis. Here are some key benefits to your business:

Access a market-leading tool

Experiments is a unique forecasting tool that allows you to get ahead of Companies House filings and get a picture of what the company's finances might look like past the financial year-end. This gives you a significant advantage over competitors.

Explain your decision-making with ease

You can select custom data and download the evidence-backed results into Excel. This means you can easily explain the data and your business decisions.

Save valuable time

Time is money, and this tool enables empowered decision-making in minutes. Simply enter the business data, and wait for Experiments to provide an updated H-Score®. This gives you a clear indication of the likelihood a business might fail.

Forecast with ease

Forget carrying out complex and time-consuming stress-tests and risk analysis. Experiments is the easiest way to access reliable financial forecasting.

The past few years of economic instability have highlighted just how important it is to be prepared for anything.

Experiments can provide you with accurate predictions of the likelihood of financial distress in the companies you work with. Take your financial risk management to the next level and try Experiments for free.

You won’t regret it.