5 Things To Look For In Your Company Credit Report

Thorough due diligence should protect your company from any future market upheavals. But a simple company credit report just won’t cut it anymore.

A basic company credit report only provides the details of a company's financial history, which is essential, but not comprehensive. The simple truth is that some company credit reports are far more detailed than others.

We’re here to help you protect your business and your investments. At Company Watch, we pride ourselves on creating tools that give you an unbeatable edge when it comes to risk management. Our unique, market-leading tools like H-Score® and TextScore® will create a comprehensive and detailed company credit report you won’t find elsewhere.

Here are our top 5 things to look for in your next company credit report:

1. Transparent reporting

Transparency is key when making informed decisions for your business, particularly when the economy is in flux. You need to know how scores are calculated to have confidence in your decision-making. Most credit reference agencies will only provide a black box score in their reporting, which can leave you in a vulnerable position.

As the pool of data gets ever more vast, many companies rely solely on AI to calculate black box credit scores. Handing control over these processes to AI means you won’t know how your scores are calculated, or if they reflect your risk management priorities. Your company could be more or less vulnerable to certain types of risk. If the AI underestimates risk, you might have a false sense of security. You also risk missing out on business opportunities if the danger is exaggerated.

Our company credit reports are transparent, easy to digest, and use cutting-edge technology to calculate scores. We will arm you with intelligent and actionable insights, using charts and tables to highlight the key information. You can download a sample company credit report here.

2. Sophisticated scoring

The importance of a comprehensive company credit report can not be overstated. Traditional credit reporting often misses signs of financial distress. We’ve created an industry-leading tool to predict likely business failures. H-Score® measures the financial health of a company from several angles, including:

- Profit management

- Working capital management

- Liquidity

- Asset funding

Our advanced machine-learning uses this information and calculates overall scores based on how similar the accounts are to failed companies. We use a financial health scale of 0-100, and if a company receives a score of 25 or less, it falls into our Warning Area. Nearly every company that goes into distress is flagged in our Warning Area well in advance of the stress event.

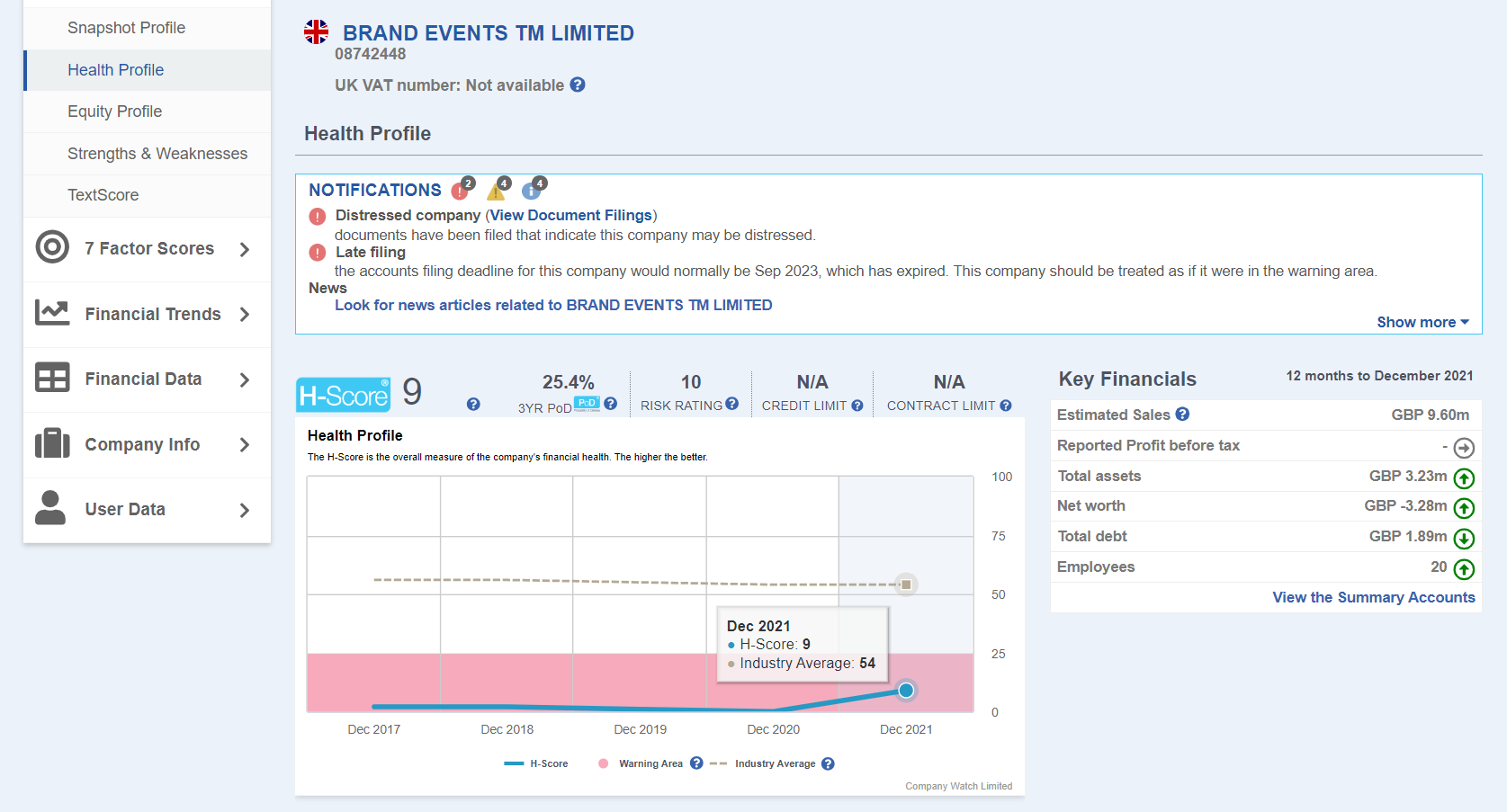

We’ve seen the results of a serious risk assessment failure recently with the collapse of Pub in the Park food festival, under parent company Brand Events TM Limited. There are 19 creditors, including two council authorities, with financial losses totalling around £3 million. As is often the case in these unfortunate events - the signs of distress were there well in advance.

Brand Events TM Limited has been in the Company Watch Warning Area since 2017 (see below). This highlights the importance of meticulous risk assessment. Financial distress of the parent company often has serious implications for subsidiaries.

3. Forecasting future distress

If the recent economic turbulence has taught us anything, it’s how important financial forecasting is. You need a company credit check that will map long-term and medium-term risks. This will allow you to mitigate risks before they become losses.

At Company Watch, our company credit reports include a Probability of Distress (PoD®) to provide you with a percentage probability that a stress event might occur within one to three years. This might be business failure, reconstruction or acute financial address.

We use the following to calculate our PoD®:

- H-Score®

- Rate of distress across the full population of companies

- Historical rate of distress at each point on the H-Score® rating scale

- Economic indicators

A company credit report providing long-term financial mapping will empower your business to invest wisely and mitigate financial risk.

Follow us on LinkedIn for the latest news and updates

4. Analysis above and beyond financials

As we’ve mentioned, traditional credit scores only scratch the surface of financial analysis. For a company credit report to give you an edge over the competition, you need a report that goes above and beyond.

While our H-Score® provides the most robust financial analysis on the market, a company’s distress might not be indicated until the next trading period. This means that early warning signs could still slip under the radar.

That’s where TextScore® comes in. This unique tool supercharges your financial risk management:

- TextScore® harnesses the power of natural language processing (NLP) to help you uncover risk.

- It delves deep into the financial reports of publicly listed and large private UK companies.

- TextScore® extracts insights and flags stress indicators, analysing the sentiment of thousands of words and phrases.

- It assesses if the language or word patterns are similar to a failed company.

We run this sentiment analysis alongside H-Score®, to then provide you with a Combined Score. This Combined Score provided in our credit reports is the most accurate indicator of corporate distress available.

5. Credit limits

Another important aspect of a company credit report is to have accurate insights to determine the amount of credit to extend. A credit limit should include things like:

- Company size

- Trading activity

- Short-term exposure to creditors

- Ability to make repayments

- Working capital position

Our Credit Limits also consider the time a company has been trading and the number and value of any CCJs received. We combine tools to create this score, including H-Score®, cash flow measures, and the PoD®.

Book a free consultation today and discover how our company credit reports can help your business thrive.