What is Customer Due Diligence (CDD)?

Financial crimes like fraud, terrorist financing and money laundering remain a persistent threat to the UK’s national security and prosperity. They also pose significant risks to your business as criminals become increasingly sophisticated.

Customer due diligence (CDD) is a process that financial institutions and companies use to gather information about customers and clients. This information establishes that customers are who they say they are and ensures they are not engaged in illegal activity. It is an integral part of the Know Your Customer (KYC) process, and both CDD and KYC are important to ensure compliance with Anti-Money Laundering (AML) regulations.

In certain industries, the risk of organised financial crime is higher. Companies working in these industries are legally required to conduct financial due diligence checks on all potential customers. This applies to the following businesses:

- Money services not supervised by the Financial Conduct Authority (FCA)

- Bill payment service providers

- Unsupervised providers of accountancy services

- Estate agents

- Letting agents

- Art dealers

- Dealers of other high-value items

- Telephone and IT payment service providers

These businesses must register with HMRC and perform due diligence on all new customers.

When do you need to conduct Customer Due Diligence?

Government regulations require you to apply customer due diligence measures in the following cases:

- Establishing a new business relationship with a customer

- You suspect money laundering or terrorist financing

- A customer’s identification information is suspicious or unreliable

- An existing customer’s circumstances change

- If you are not a high-value dealer, when you carry out occasional transactions of €15,000 or more

- For high-value dealers, when you pay a supplier €10,000 or more or carry out an occasional transaction of €10,000 or more

Who oversees Customer Due Diligence?

In the UK, the Financial Conduct Authority enforces CDD compliance. Different sectors also have specific advisory and regulatory bodies, including:

- The Office for Professional Body Anti-Money Laundering Supervision (OPBAS)

- HMRC

- The Solicitors Regulation Authority

- UK Gambling Commission

- The Association of Chartered Certified Accountants,

These bodies issue requirements in each sector that businesses must follow to prevent financial crimes.

What are the 4 Customer Due Diligence requirements?

The following basic regulatory obligations are required when conducting CDD:

1. Customer identification and verification

You must verify your customer's identity via enhanced due diligence checks by obtaining personal information and data, including:

- Name

- Address

- Information about the business, including financial history

- How they intend to use their account

You need to verify that this information is correct. This is done by referencing official documents including photographic ID, incorporation documents and utility bills.

2. Establishing the nature of the business-customer relationship

Once you have verified the customer's identity, it is key to understand what activities and transactions the customer will carry out. This is to determine the nature and purpose of the relationship you are entering into with the customer.

3. Beneficial ownership identification and verification

If a company or third party is acting on behalf of someone else, you need to establish ultimate beneficial ownership (UBO). This refers to the individual(s) who benefit from the activities of a person or group of persons.

4. Ongoing monitoring for suspicious activities

Financial due diligence is an ongoing process. You must continue to monitor a company's transactions throughout the business relationship to ensure transactions align with the company’s established risk profile.

What is Enhanced Due Diligence?

As part of the customer due diligence process, you must establish if further measures are needed. In certain cases, standard due diligence isn’t enough to eliminate the threat of financial crime. As criminals find new ways to exploit new technology, finding risks hidden deep on the internet is increasingly difficult.

Enhanced due diligence (EDD) is a comprehensive investigative process to gather in-depth information and assess higher-risk individuals, entities, or business transactions.

You’ll be required to conduct EDD when:

- Entities are from high-risk countries

- An individual is not physically present for ID checks

- Entities are Politically Exposed Persons

- Transactions involve high-risk industries

- Entities include high-net-worth individuals with complex business structures

- Entities have a history of criminal activity

- Businesses have significant cash transactions

If any of these are present, a business requires deeper scrutiny and EDD is legally required. Typical EDD checks include:

- Gathering more information to establish the customer’s identity

- Taking extra measures to check documents supplied by a credit or financial institution

- Investigating the source of the company’s funds

It is also critical to avoid some common mistakes while conducting enhanced due diligence checks. When dealing with Politically Exposed Persons, you will need to take the following measures:

- Ensure only senior management approves new business relationships

- Establish where the person’s wealth and the funds involved in the business relationship come from

- Conduct stricter ongoing monitoring of the business relationship

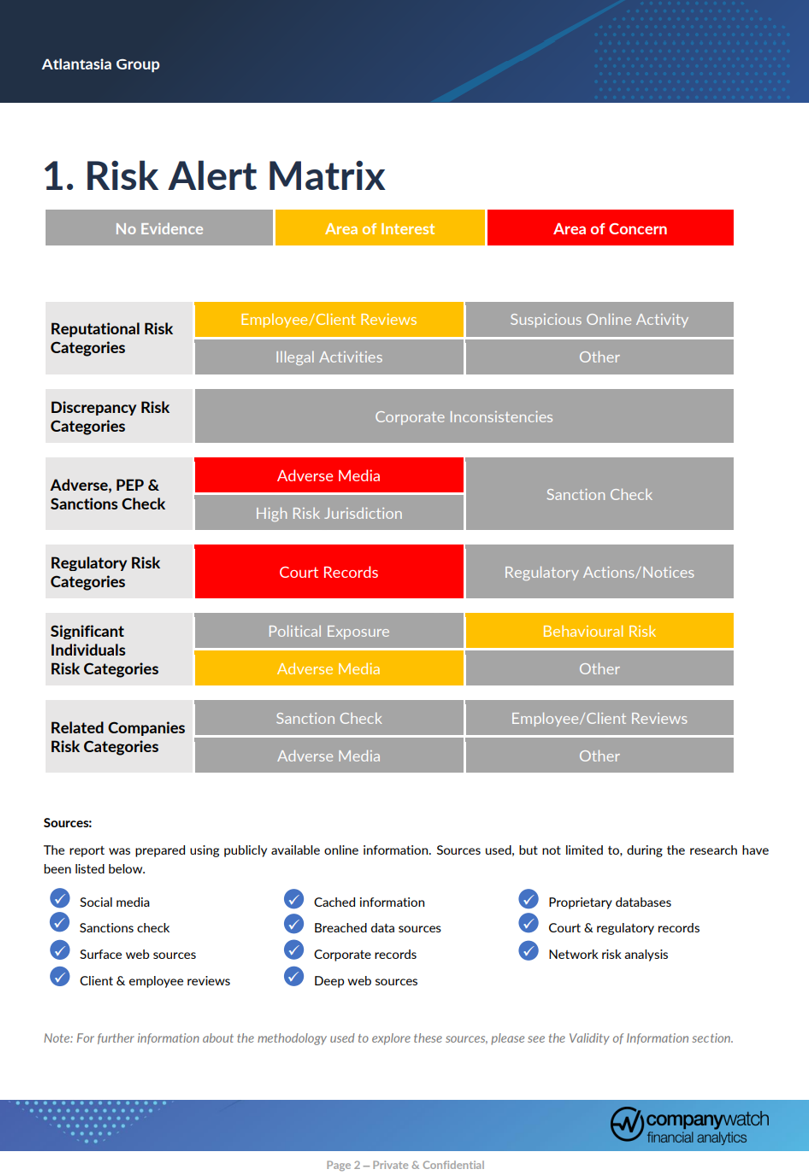

Deep web insights

At Company Watch, our EDD tools conduct financial due diligence to help you shine a light into the corners of the deep and dark web to protect your business from financial risk. Other providers may only use Google to collect information, but these searches only cover around 6% of the internet, leaving plenty of places for criminals to hide. Our tools scour through over 600bn archived web resources and 202m corporate records.

Here are just some of the sources we use to conduct our enhanced due diligence:

|

Comprehensive web search |

We conduct a surface web and deep web search to uncover red flags. |

|

Employee and client reviews |

We comb through review sites like Glassdoor and flag negative reviews. |

|

Social media accounts |

With access to more than 300 platforms, we conduct data analysis of a company’s content and any content posted about the company by others. |

|

Press & Media |

We search through open-source and proprietary media databases covering over 40,000 media sources. |

|

Corporate records |

We can access both active and inactive corporate records, with over 202 million records available in our global repository. |

|

Cached information |

We check for and analyse cached versions of 600bn+ webpages. |

|

Network risk analysis |

We conduct a thorough analysis, including social media content analysis, PEP and sanctions, regulatory and law enforcement database searches, and adverse internet checks. |

|

Breached data sources |

We probe the dark web to check for breached and compromised data. |

|

Court & regulatory databases |

We conduct court & regulatory checks in the company’s jurisdictions. |

Our marketing-leading Enhanced Due Diligence Reports provide a comprehensive, easily digestible risk analysis. Once we’ve gathered our deep web insights and other relevant data, the information is analysed and presented using interactive charts and detailed explanations.

Why is Customer Due Diligence so important?

Conducting thorough customer due diligence checks is vital for several reasons.

1. Compliance with regulations

Conducting CDD will ensure your compliance with government legislation and avoid legal repercussions. As financial crime remains a thorn in the UK economy, restrictions have tightened and fines are increasing. In 2023 the FCA handed out over £53 million in penalties.

2. Combat sophisticated threats

Criminals are using more sophisticated means to remain undetected. Failure to uncover these bad actors can put your business at serious risk. Customer due diligence can help you flag suspicious behaviour before entering new business partnerships.

3. Mitigate reputational damage

Working with businesses involved in criminal activity has financial and legal implications. The reputational damage of being associated with a criminal enterprise can be difficult to recover from. Having stringent customer due diligence checks shows you are committed to ethical conduct and builds trust with your clients.

4. Ensure economic stability

Effective customer due diligence contributes to a stable economy by preventing the infiltration of illicit funds into the financial sector. This helps maintain market integrity and ensures fair competition.

How Company Watch can take the stress out of the Customer Due Diligence process

At Company Watch, we’ve developed the ultimate risk management system - our dedicated financial risk platform. Using advanced technology, our financial risk platform includes all our market-leading tools, solutions and functionality, making conducting CDD and EDD a breeze. Our tools work together to protect your business from all angles and give you the confidence to make evidence-based decisions.

Here are just some of the innovative tools that help us stand out from the competition:

|

Our unique tools, scoring and functionality |

How it works |

|

Enhanced Director Matching |

This function lets you identify company directors along with any history of insolvencies. You can see all possible directorships (past and present) that an individual may have held. If there is any cause for concern, you can proceed to carry out EDD on the individual or company in question. |

|

Portfolio Monitoring |

Our platform performs daily checks on all of your customers and suppliers. You will receive an automated alert in your inbox as soon as something changes (e.g. filings at Companies House, profit warnings, a notice of intention to appoint an administrator, or changes to financial health). |

|

Experiments |

This unique tool stress-tests a company's financial health and runs ‘what if’ scenarios using management accounts or forecasts. |

|

TextScore® |

TextScore® predicts the probability of corporate distress using advanced machine learning to analyse the text in financial reports of active companies. |

|

H-Score® |

H-Score® measures a company’s financial health using published financial results and analyses a company’s financial position from several angles including profit management, working capital management, liquidity and how assets are funded. Scores (between 0 and 100) are based on how closely the accounts resemble those of companies which subsequently failed. Companies with an H-Score® of 25 or under are placed in the Warning Area. |

|

Forecast View™ |

Forecast View™ is our financial modelling tool that helps you spot future risks. This state-of-the-art tool gives you an insight into economic events' impact on a company’s financial health. |

|

Data Search |

Data Search lets you filter the UK company population and identify companies with a specific profile. You can uncover signs of potential distress and identify growth opportunities. |

These are just some of the cutting-edge tools you’ll get access to if you subscribe to our platform. We’re confident you won’t regret joining us, but don’t just take our word for it.